Lessons learned from economic and weather forecasting

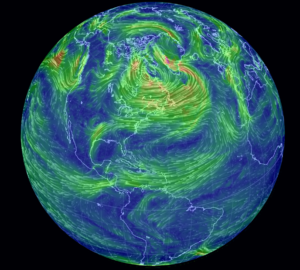

“Weather forecasters are the only people to be wrong half the time and still get paid.” This is a saying to reflect the belief many people have pertaining to weather forecasters’ abilities. Meteorology is an incredibly challenging field, and the fact that weather forecasts are occasionally inaccurate has more to do with predicting events in an incredibly complex system than the professional skills of weather forecasters.

There are a lot of similarities between risk management and weather forecasting, and risk management professionals can learn a lot from studying how weather forecasters have approached the challenging task of predicting future events. An important component of a risk manager’s job involves forecasting trends, communicating the uncertainty of forecasts, and helping business people make risk-aware decisions.

Dynamic systems give forecasters plenty of problems. World economies are continually evolving in a chain reaction of events, making it very difficult to predict future outcomes. Nonlinear systems are problematic too. The mortgage-backed securities that triggered the financial crisis were designed in such a way that small changes in macroeconomic conditions could make them exponentially more likely to default. Combining these two properties can cause turmoil.